Businesses can easily open and close accounts every period by using accounting software to track all financial transactions throughout a given period. Automating accounting opening entries and closing entries can help streamline this process, so you don’t have to. Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period’s closing entries.

Example of Closing Entries

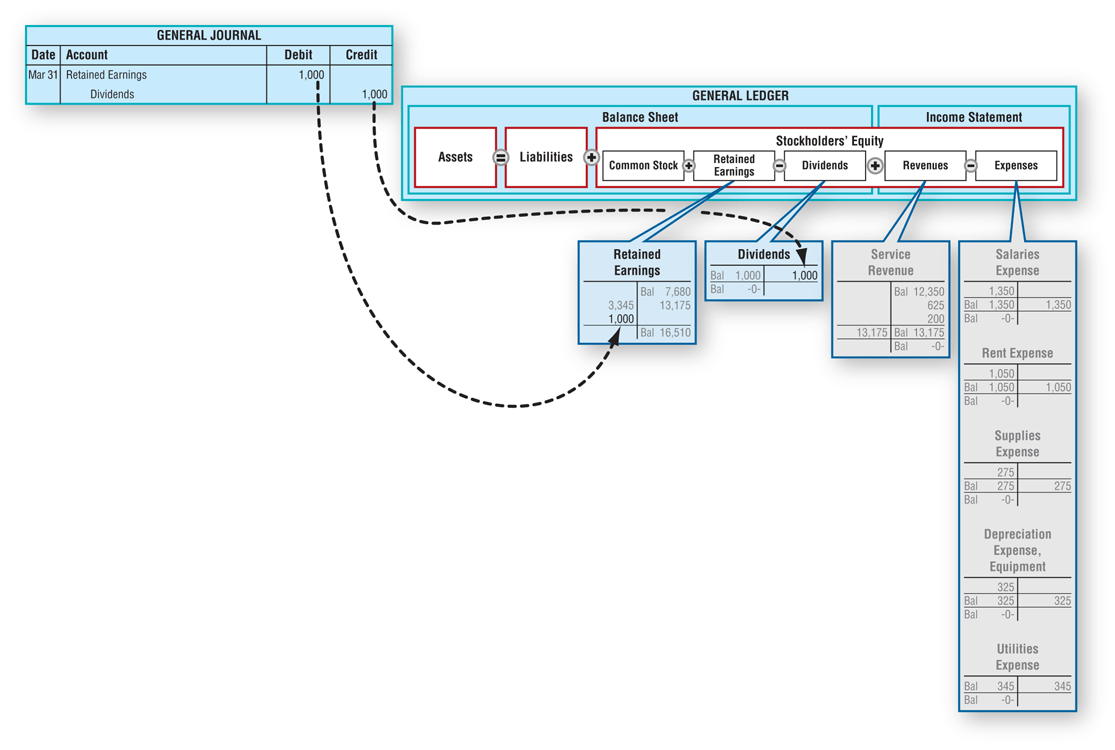

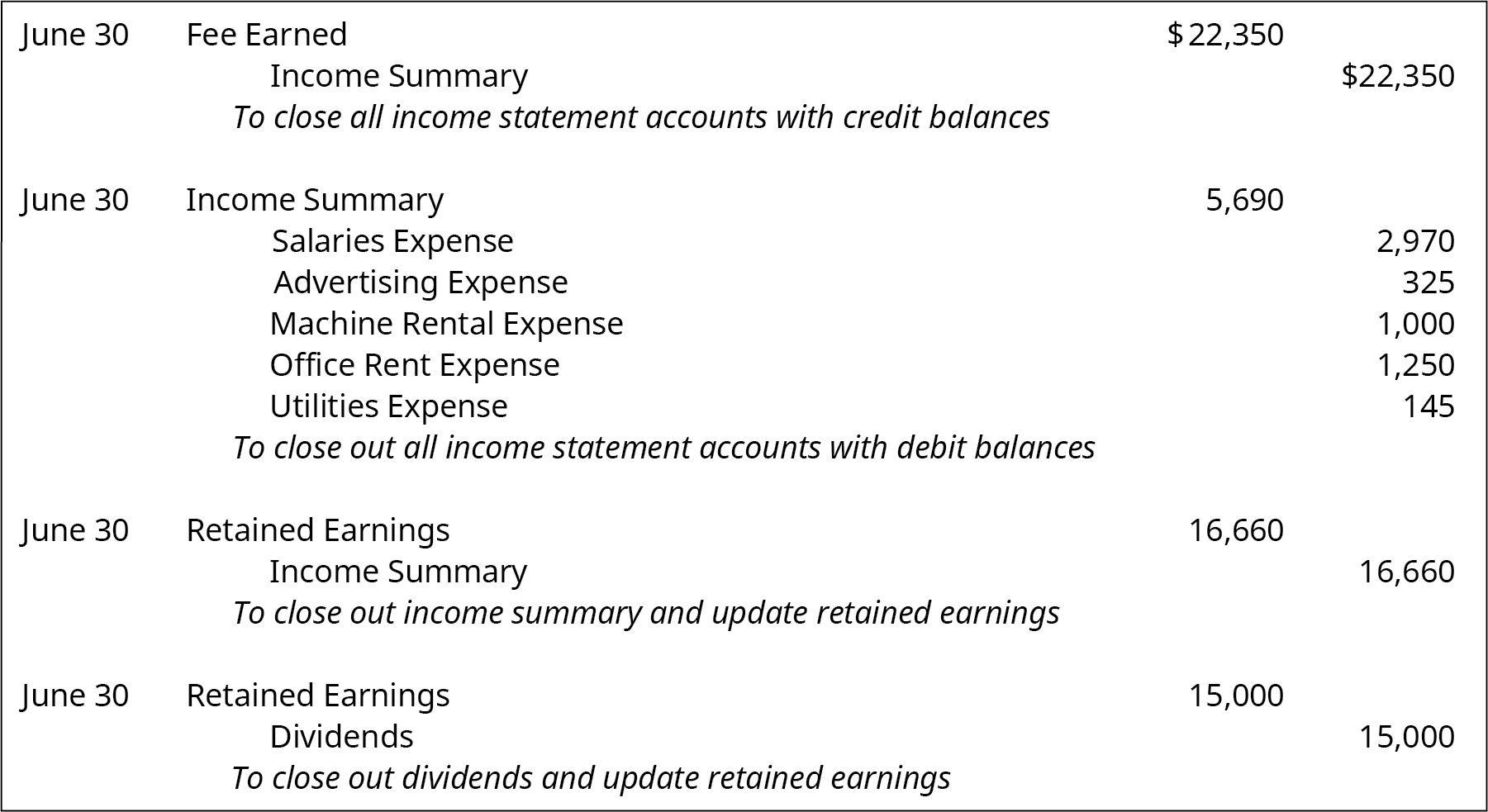

Thebalance in the Income Summary account equals the net income or lossfor the period. This balance is then transferred to the RetainedEarnings account. The next step is to repeat the same process for your business’s expenses. All expenses can be closed out by crediting the expense accounts and debiting the income summary. At the end of a financial period, businesses will go through the process of detailing their revenue and expenses. We see from the adjusted trial balance that our revenue account has a credit balance.

How confident are you in your long term financial plan?

Here are MacroAuto’s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. From the Deskera “Financial Year Closing” tab, you can easily choose the duration of your accounting closing period and the type of permanent account you’ll be closing your books to. We at Deskera offer the best accounting software for small businesses today.

Step 3: Clear the balance in the income summary account to retained earnings

- This involved reviewing, reconciling, and making sure that all of the details in the ledger add up.

- Remember that net income is equal to all income minus all expenses.

- Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod.

- The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses.

- All accounts can be classified as either permanent (real) ortemporary (nominal) (Figure5.3).

Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances. The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year?

Record to Report

After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300. Closing entries are put into action on the last day of an accounting period. There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances.

Although it is not an income statement account, the dividend account is also a temporary account and needs a closing journal entry to zero the balance for the next accounting period. Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. The xero pricing features reviews and comparison of alternatives entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely. The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger. The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account. The $10,000 of revenue generated through the accounting period will be shifted to the income summary account. In this example, the business will have made $10,000 in revenue over the accounting period. In this example, it is assumed that there is just one expense account.

This time period, called the accounting period, usually reflects one fiscal year. However, your business is also free to handle closing entries monthly, quarterly, or every six months. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary. An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter. Dividend account is credited to record the closing entry for dividends.

For example, in the case of a company permanent accounts are retained earnings account, and in case of a firm or a sole proprietorship, owner’s capital account absorbs the balances of temporary accounts. There may be a scenario where a business’s revenues are greater than its expenses. This means that the closing entry will entail debiting income summary and crediting retained earnings. But if the business has recorded a loss for the accounting period, then the income summary needs to be credited. The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the closing journal entries have been made. This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the retained earnings account as shown below.

The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. The accounts that need to start with a clean or $0 balance goinginto the next accounting period are revenue, income, and anydividends from January 2019. To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand.