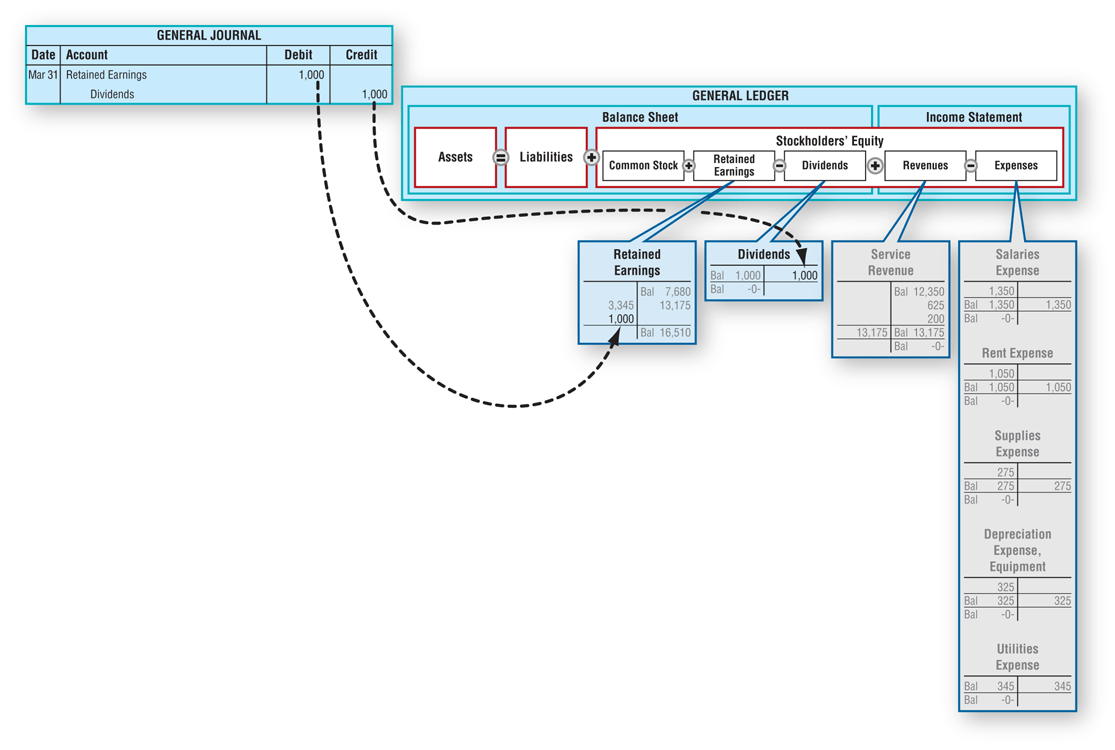

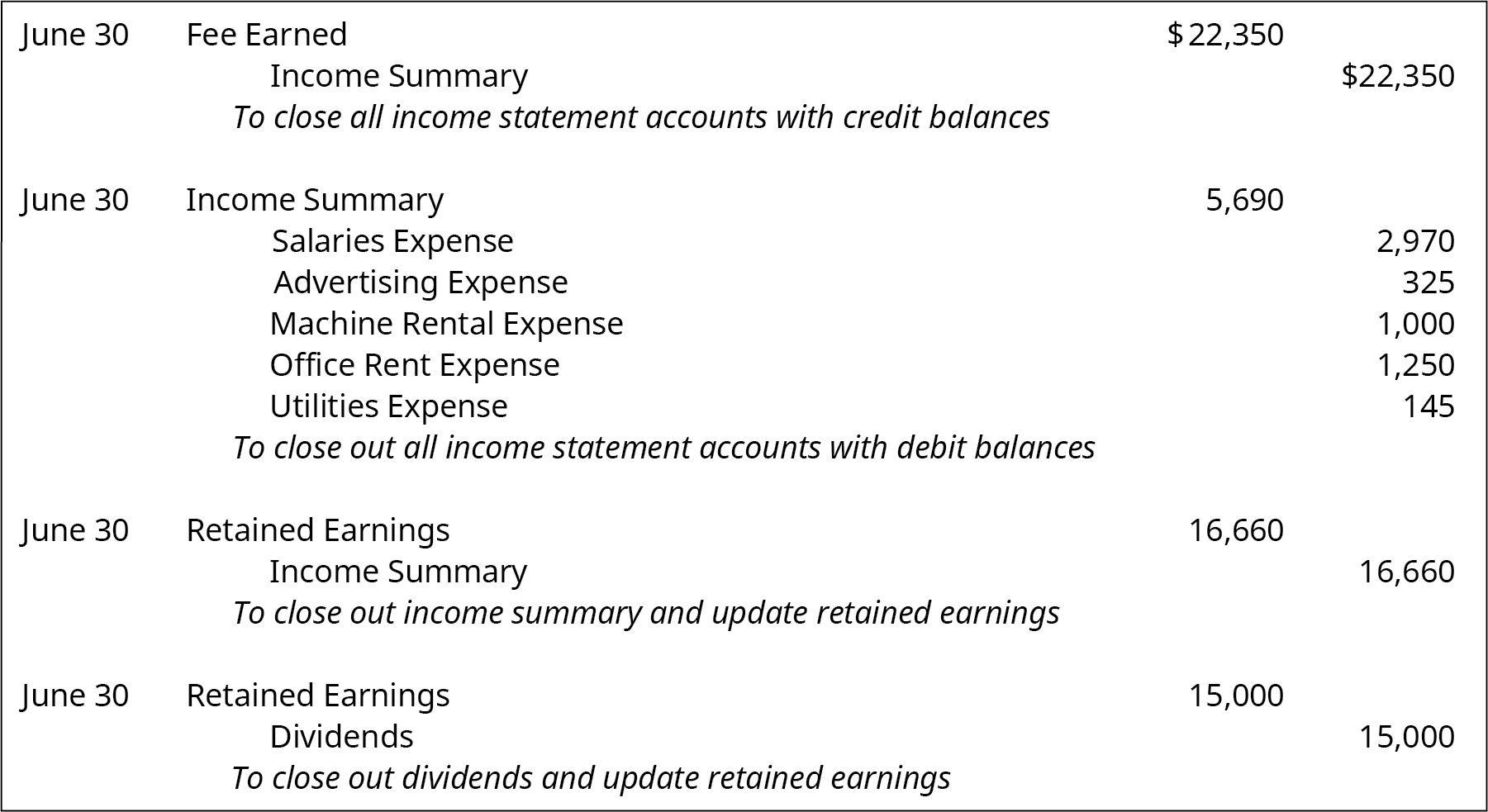

Only income statement accounts help us summarize income, so only income statement accounts should go into income summary. Our discussion here begins with journalizing and posting the closing entries (Figure 5.2). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded. The closing journal entries example comprises of opening and closing balances. Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

What is the Income Summary Account in Closing Entries?

Then, head over to our guide on journalizing transactions, with definitions and examples for business. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). Keep in mind, however, that this account is only purposeful for closing the books, and thus, it is not recorded into any accounting reports and has a zero balance at the end of the closing process. Thus, the income summary temporarily holds only revenue and expense balances. Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent.

Why You Can Trust Finance Strategists

The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance. Theclosing entry will credit Dividends and debit RetainedEarnings. What is the current book value ofyour electronics, car, and furniture? Are the value of your assets andliabilities now zero because of the start of a new year? Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt.

Step 1: Transfer Revenue

Are the value of your assets and liabilities now zero because of the start of a new year? Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period. Then you are going to create a journal entry to transfer the balance of each temporary account to the appropriate permanent account. For example, the balance of a revenue account will go to the income summary. The next step is to repeat the same process for your business’s expenses.

Once all of the temporary accounts have been closed, review the journal entries to ensure that they are accurate and complete. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. Understanding the accounting cycle and preparing trial balancesis a practice valued internationally.

- The income summary account is a temporary account solely for posting entries during the closing process.

- When you compare the retained earnings ledger (T-account) to the statement of retained earnings, the figures must match.

- Notice that the Income Summary account is now zero and is ready for use in the next period.

- The closing journal entries example comprises of opening and closing balances.

Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff. Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders. The income statement summarizes your income, as does income summary. If both summarize your income in the same period, then they must be equal. The business has been operating for several years but does not have the resources for accounting software. This means you are preparing all steps in the accounting cycle by hand.

All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet. Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019.

In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are referred to as interim periods and the accounts produced as interim financial statements. Interim periods are usually monthly, quarterly, or half-yearly.

The second entry requires expense accounts close to the Income Summary account. To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, software outsourcing in romania each with a debit balance on the adjusted trial balance. The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account.

After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300. In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company. The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders’ equity section of the balance sheet.

Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period.